Put in the work

Many factors play a role in the ability to create and run a business, and the road to entrepreneurial success can be quite daunting. Having enough capital to get your organization off of the ground and maintain momentum during challenging times is critical. After several months of creating a solid business plan, many entrepreneur’s enthusiasm will quickly wane upon being confronted with the bottom line. Don’t store your plans away in your desk drawer – in the abyss of other long-forgotten dreams – just yet. Good news, there are excellent resources that can help you meet your goals and establish a solid foundation for your business. You just have to be willing to put in the work. The return on the time invested will pay off big, considering startup funding can transform your business plans into an achievable reality.

Multiple funding options are available for you to choose from. Preparation and research will be essential in finding the right method for your business. Ultimately, your best choice for funding will depend on the needs of your organization. Some determining factors that may help to narrow down your selection will include: whether or not you qualify for particular sources of funding, if you prefer to acquire debt- allowing you to maintain full control of your company, alternatively you may rather exchange capital or services for equity.

Real talk

Before you begin your campaign to raise capital, the first thing you will want to do is revisit your business plan. Get a realistic idea of how much money you will need to pull together on your own and/or how much you will need to request from outside resources. Aim to cut any unnecessary costs. Your goal should be to acquire enough capital to start and maintain your organization, not to luxuriate with all of the bells and whistles. You will earn that in time. There are benefits to keeping startup costs low: it may inspire you to invest your own personal savings, perhaps it will make you a more favorable candidate for a business loan, and it will certainly appeal to any potential investors. Also, be sure that your financial projections are pragmatic; idealistic financial projections can easily halt your company’s growth down the line, if not bankrupt your business.

Choose your method

Once you have a firm grasp on a viable dollar amount, it’s time to consider sources of capital to pursue. Essentially, there are two types of funding options: debt and equity, unless you will be using your own personal funds. Of course, there are advantages and disadvantages to each method.

- Debt: An advance of funds is a great way to ensure that all profits and assets remain with you and your business. Although you will initially go into debt, once your debt is paid all profits go directly to you and you will remain in full control of your business. However, the inability to repay your debt could cost you your business, reputation and more. In addition, not everyone has the ability to obtain a loan, whether that be via a financial institution or from friends and family. If obtaining a loan appeals to you, try reaching out to these potential sources.

- Friends and Family

- Financial Institutions

- Angel Investors

- Venture Capitalists

- SBA: matching small businesses with lenders

- Equity: Selling shares in your company in exchange for capital or services is a popular method for raising funds. In lieu of qualifying for a loan, an innovative idea and well laid out business plan can get you the financial resources needed to accelerate the momentum of your startup. Avoiding debt helps to reduce personal risk and increases peace of mind. Note, some may consider sharing in profits and ideas on how the business should be managed, to be a drawback when choosing this approach. The amount of resources available to you are numerous. Here is a list of potential investors that could believe in your vision so much, they want a piece of the action.

- Friends and Family

- Crowdfunding

- Angel Investors

- Venture Capitalist

- Business Partner(s)

- Other companies or individuals willing to trade their services for a stake in your company

- Personal savings: If you are fortunate enough to have personal savings that will allow you to successfully create, run and sustain your business, this is a wonderful option. Not only will you avoid accruing any debt, you will also be able to solely reap the rewards of your time and financial investment. Many entrepreneurs enjoy the full control that comes with using their own financial resources to fund their business. Keep in mind, with this method the control is yours but the personal risk is yours as well. Many startups do not make it to the fifth year of business. It is quite possible to lose your nestegg.

Don’t go it alone

The search for funding can be extremely competitive and you will face rejection, many times. Don’t give up. The funds are out there, all you will need to do is figure out how to get them. Whether you decide to use your personal savings, secure a loan, exchange equity or utilize multiple methods of raising capital for your business, bringing in the right attorney for your startup is paramount. Sentient Law is your resource for all startup legal services. Matthew Rossetti is here to guide you though taking the proper steps and precautions that will ensure your business is built on a solid foundation and is prepared to withstand any internal shifts and external pressures.

- Entity Planning, Selection, and Formation

- Contracts and Agreements

- Dynamic Equity Agreements

- Deferred Compensation Plans (Employee Stock Ownership Plans, Stock Appreciation Rights, etc.)

- Alternative Dispute Resolution (Arbitration and Mediation)

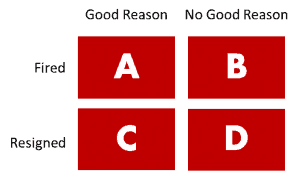

- Labor and Employment

- Slicing Pie Lawyer

- Executive Estate Planning